Insightful Risk Management Your Compass to Confident Decision making Choices.

The ERM landscape is constantly evolving, and organizations must adapt to stay ahead of emerging risks and opportunities. By embracing insightful risk management and prioritizing resilience, organizations can navigate uncertainties with confidence. Ultimately, a well-implemented ERM framework serves as a compass for decision-making, guiding organizations toward sustainable success in an ever-changing environment. Leadership plays a crucial role in fostering a culture of risk awareness and resilience within an organization. By promoting open communication and encouraging proactive risk management practices.

These risks arise from the fundamental decisions that affect the direction of the organization. They can stem from market competition, changes in consumer preferences, or shifts in regulatory frameworks. Organizations must continuously assess their strategic positioning to mitigate these risks.

Operational risks are associated with the internal processes, systems, and people that drive an organization’s day to day activities. This includes risks related to supply chain disruptions, technology failures, and human errors. Effective operational risk management is crucial for maintaining efficiency and productivity.

Financial risks involve the potential for monetary loss due to market fluctuations, credit risks, liquidity issues, or investment losses. Organizations must implement robust financial controls and forecasting methods to manage these risks effectively.

With the ever evolving regulatory landscape, organizations face compliance risks that can lead to legal penalties and reputational damage. Staying informed about relevant laws and regulations is essential for mitigating compliance rel

The perception of an organization by its stakeholders can significantly impact its success. Reputational risks can arise from negative publicity, poor customer service, or unethical practices. Organizations must actively manage their reputation through transparent communication and ethical behavior.

The enterprise risk landscape encompasses various types of risks, including operational, financial, strategic, compliance, and reputational risks. Understanding these risks is the first step in developing a robust risk management framework. Organiza-tions should conduct a comprehensive risk assessment to identify potential threats and vulnerabilities that could affect their objectives.

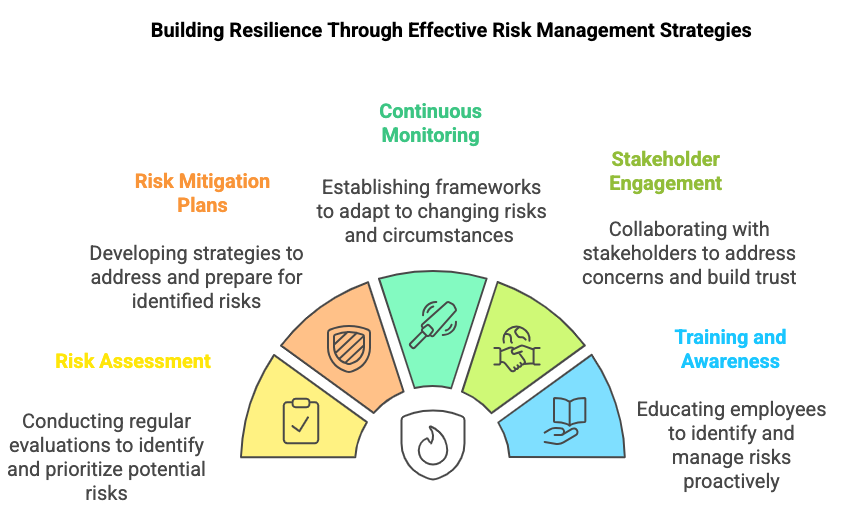

Conduct regular risk assessments to identify and evaluate potential risks. This involves analyzing the likelihood and impact of various risks on the organization.

Develop and implement risk mitigation strategies tailored to the specific risks identified. This may include diversifying supply chains, investing in technology, or enhancing compliance training.

Establish a framework for continuous monitoring of risks and the effectiveness of mitigation strategies. This allows organizations to adapt to changing circumstances and emerging risks.

Engage with stakeholders, including employees, customers, and investors, to understand their concerns and expectations. This can help organizations address reputational risks and build trust.

Foster a culture of risk awareness within the organization through training and education. Employees should be equipped with the knowledge and tools to identify and report potential risks.

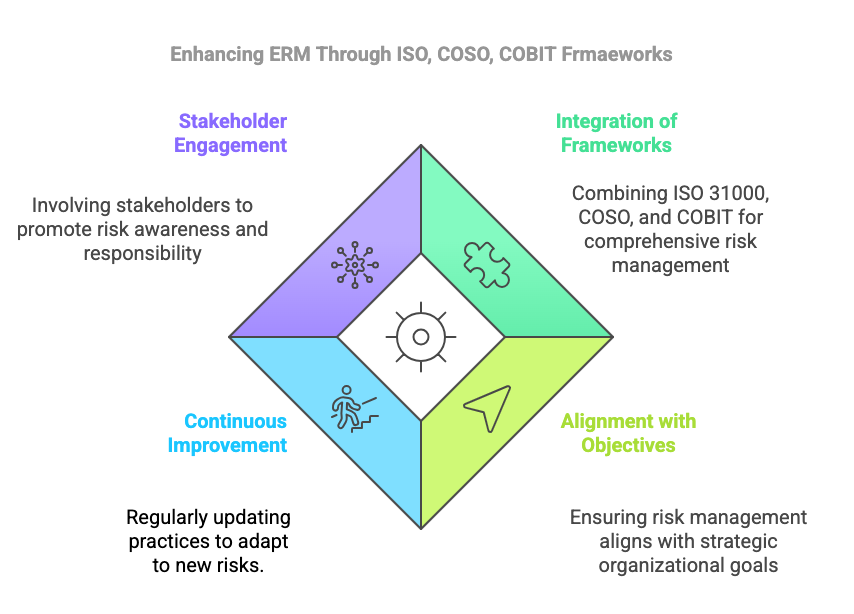

Enterprise Risk Management (ERM) is a vital framework that organizations utilize to navigate uncertainties and protect their objectives. While ERM defines the strategic approach to risk management, frameworks like ISO 31000, COBIT, and COSO provide the necessary guidelines and principles for effective implementation. Understanding the relationship between ERM and these frameworks is crucial for organizations aiming to establish a comprehensive risk management strategy that aligns with their goals and enhances resilience against potential risks.

Implementing Enterprise Risk Management features using StratRoom software provides organizations with a structured and efficient approach to managing risks. By focusing on the key components of Identify, Assess, Mitigate, Monitor, Control, and Report, organizations can enhance their risk management processes, ultimately leading to better decision-making and improved organizational resilience.

ThThe first step in the ERM process is to identify potential risks that could impact the organization. StratRoom provides tools for:

Risk Identification Workshops: Facilitate collaborative sessions to brainstorm and document risks.

Risk Register: Maintain a centralized repository of identified risks, categorized by type, source, and potential impact.

Automated Risk Alerts: Set up notifications for emerging risks based on predefined criteria.

Once risks are identified, the next step is to assess their potential impact and likelihood. StratRoom supports this phase through:

Risk Assessment Matrix: Utilize visual tools to evaluate risks based on severity and probability.

Qualitative and Quantitative Analysis: Apply different assessment methods to gain a comprehensive understanding of risks.

Scenario Analysis: Model potential outcomes based on varying risk scenarios to inform decision-making.

After assessing risks, organizations must develop strategies to mitigate them. StratRoom aids in this process by offering:

Mitigation Planning: Create and assign action plans to address identified risks, including timelines and responsible parties.

Resource Allocation: Optimize the allocation of resources to ensure effective risk mitigation efforts.

Integration with Business Processes: Align risk mitigation strategies with organizational objectives and processes.

Continuous monitoring of risks is essential for effective ERM. StratRoom provides features for:

Real-time Risk Monitoring: Track risk indicators and changes in the risk landscape through dashboards and reports.

Key Risk Indicators (KRIs): Define and monitor KRIs to provide early warning signals for potential risk events.

Regular Review Cycles: Establish a schedule for periodic reviews of risks and mitigation strategies.

Implementing controls is vital to manage risks effectively. StratRoom facilitates this through:

Control Framework: Develop a structured approach to implementing controls that align with risk management objectives.

Control Testing and Validation: Regularly test controls to ensure they are functioning as intended and adjust as necessary.

Compliance Tracking: Monitor adherence to regulatory requirements and internal policies related to risk management.

Finally, effective communication of risk management activities is crucial. StratRoom enhances re-porting capabilities by:

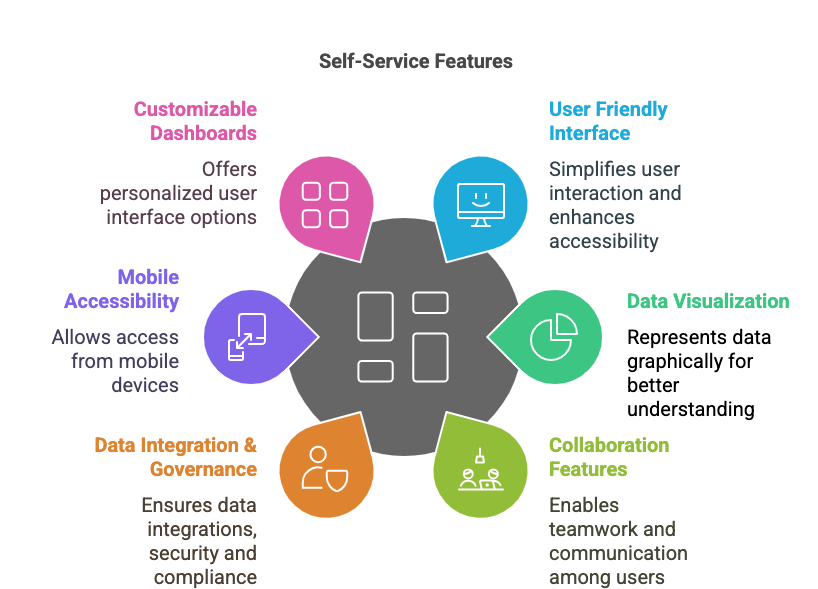

Customizable Reporting Templates: Generate reports tailored to various stakeholders, including executive summaries and detailed analyses.

Dashboard Visualizations: Utilize visual tools to present risk data clearly and concisely.

Stakeholder Engagement: Facilitate communication with stakeholders to ensure transparency and accountability in risk management efforts.

StratRoom’s ERM is solutions are designed to empower organizations by providing a comprehensive framework supporting ISO, COSO, COBIT etc… for Enterprise Risk man-agement. It allows organizations to systematically identify potential risks, assess their impact, and implement strategies to mitigate them. This proactive approach not only safeguards the organization but also enhances decision-making processes.

StratRoom provides a robust framework for conducting thorough risk assessments. By utilizing ad-vanced analytics and data-driven insights, organizations can identify potential risks across various domains, including operational, financial, strategic, and compliance related risks. This holistic approach enables businesses to prioritize risks based on their potential impact and likelihood, allowing for more informed decision-making.

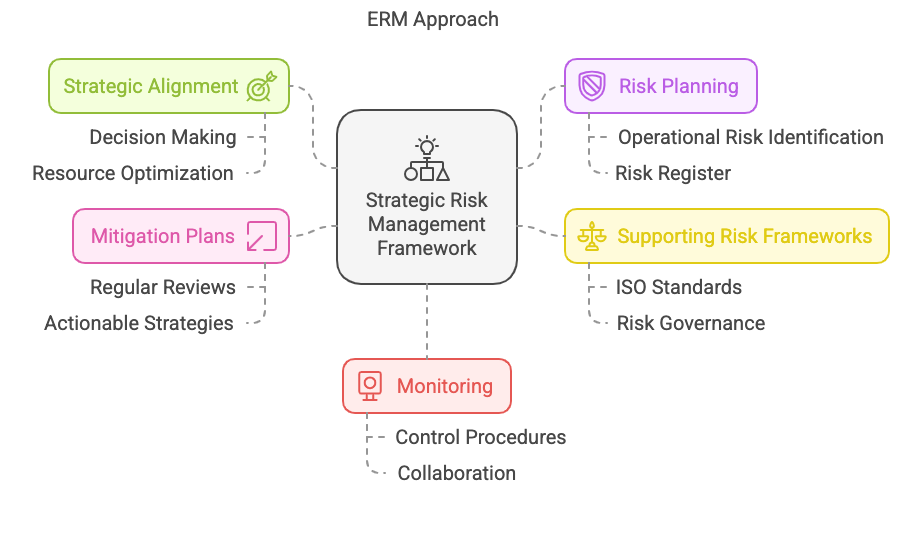

Clearly articulate the organization's strategic goals and objectives. This provides a foundation for identifying relevant risks.

Conduct a comprehensive risk assessment to identify potential risks that could impact the achievement of strategic objectives.

Evaluate the likelihood and impact of identified risks. Prioritize them based on their poten-tial effect on strategic goals.

Ensure that risk considerations are incorporated into the strategic planning process. This in-cludes regular reviews and updates to the risk management framework as business strategies evolve.

Continuously monitor the risk landscape and review the effectiveness of risk management strategies. Adapt and refine approaches as necessary to maintain alignment with strategic ob-jectives.

StratRoom’s Risk Management Solution stands out as a preferred choice for organizations seeking to enhance their risk management capabilities. With its comprehensive assessment tools, customizable features, real-time monitoring, collaborative platform, regulatory compliance support, and cost-effectiveness, StratRoom empowers businesses to proactively manage risks and thrive in an uncertain environment. Embrace the future of risk management with StratRoom and safeguard your organization's success.