The significance of compliance and audit is paramount. These functions play a crucial role in risk management, operational efficiency, corporate governance, and informed decision-making. By integrating compliance and audit into the strategic framework, organizations can protect their assets and reputation while also preparing for sustainable growth in a complex business environment. Recognizing these functions as strategic partners will ultimately foster a more resilient and successful organization.

Identification of Risks: Compliance and audit processes help organizations identify potential risks that could impact their operations. By systematically evaluating internal controls and compliance with regulations, organizations can pinpoint vulnerabilities and mitigate risks before they escalate.

Mitigation Strategies: Once risks are identified, compliance and audit functions assist in developing effective mitigation strategies. This proactive approach not only protects the organization from potential losses but also enhances its reputation and stake holder trust.

Adherence to Laws and Regulations: Organizations are required to comply with a myriad of laws and regulations. A robust compliance framework ensures that the organization adheres to these legal requirements, thereby avoiding penalties, fines, and reputational damage.

Continuous Monitoring: Compliance is not a onetime effort but requires ongoing monitoring and adjustments. Regular audits help organizations stay updated with changing regulations and ensure continuous compliance, which is vital for long term sustainability.

Streamlining Processe: The audit process often uncovers inefficiencies within organizational processes. By identifying areas for improvement, organizations can streamline operations, reduce waste, and enhance productivity

Resource Allocation: Effective compliance and audit functions provide insights into resource allocation. By understanding where resources are best utilized, organizations can optimize their operations and improve overall efficiency.

Informed Decisions: Compliance and audit functions provide critical data and insights that inform strategic decision making. Leaders can make better decisions based on a comprehensive understanding of risks, compliance status, and operational efficiency.

Long-term Planning: Incorporating compliance and audit considerations into long term strategic planning ensures that organizations are prepared for future challenges and opportunities. This foresight is essential for sustainable growth.

Building Trust: A strong compliance and audit framework enhances an organization’s reputation. Stakeholders, including customers, investors, and regulators, are more likely to trust organizations that demonstrate a commitment to ethical practices and compliance.

Crisis Management: In the event of a compliance breach or audit finding, having a robust framework in place allows organizations to respond swiftly and effectively. This capability is crucial for managing crises and protecting the organization’s reputation.

Transparency: Compliance and audit functions promote transparency within the organization. By openly sharing compliance efforts and audit findings with stake holders, organizations can foster trust and engagement.

Stakeholder Expectations: Understanding and meeting stakeholder expectations regarding compliance and governance is essential. Regular audits and compliance checks help organizations align their practices with stake

The integration of compliance and audit functions into the overall corporate strategy is not just a regulatory requirement; it is a strategic necessity. As companies operate within a more regulated environment, it is crucial to adopt a unified approach that aligns these functions with corporate objectives. This alignment promotes a culture of accountability, improves risk management, and ultimately supports the long-term success of the organization.

By aligning compliance and audit functions with corporate strategy, organizations can better identify, assess, and mitigate risks that could impede their strategic objectives. This proactive approach ensures that potential compliance issues are addressed before they escalate.

Strategic alignment allows organizations to allocate resources more effectively. By understanding the corporate strategy, compliance and audit teams can prioritize their efforts on areas that directly impact the organization's goals, leading to more efficient use of time and resources.

When compliance and audit functions are integrated into the corporate strategy, decision makers have access to critical insights that inform their choices. This data driven approach enhances the organization's ability to respond to challenges and seize opportunities.

Organizations that prioritize compliance and audit alignment with their corporate strategy demonstrate a commitment to ethical practices and regulatory adherence. This commitment fosters trust among stakeholders, including customers, investors, and regulators.

In today's rapidly evolving regulatory landscape, organizations must adapt to maintain compliance and improve audit efficiency. Embracing technological innovations is essential for achieving these goals. By utilizing tools like data analytics, automation, artificial intelligence, cloud computing, and blockchain, organizations can optimize their compliance and audit procedures while also setting themselves up for sustained success in a constantly changing business environment.

Data analytics tools enable organizations to analyze vast amounts of data quickly and accurately. By employing predictive analytics, organizations can identify potential compliance risks before they escalate. This proactive approach allows for timely interventions and helps in maintaining compliance with regulatory standards.

Automation technologies, such as robotic process automation (RPA), can significantly reduce the manual workload associated with compliance and auditing tasks. By automating repetitive tasks, organizations can free up valuable resources, allowing auditors and compliance officers to focus on more strategic activities. This not only improves efficiency but also enhances the accuracy of audits.

AI technologies can assist in identifying patterns and anomalies in data that may indicate compliance issues. Machine learning algorithms can continuously learn from historical data, improving their ability to detect irregularities over time. This capability allows organizations to respond swiftly to potential compliance breaches and mitigate risks effectively.

Cloudbased solutions provide organizations with the flexibility to access compliance and audit tools from anywhere, facilitating collaboration among teams. Additionally, cloud platforms often come with built in compliance features that help organizations stay updated with changing regulations, ensuring that they remain compliant at all times.

Blockchain technology offers a secure and transparent way to record transactions, making it easier for organizations to maintain accurate records for auditing purposes. The immutable nature of blockchain ensures that data cannot be altered retroactively, thereby enhancing the integrity of compliance records.

StratRoom's clearly articulated performance management framework for compliance and audit is essential for organizations aiming to adeptly manage the intricacies of regulatory obligations. By setting explicit goals, metrics, and procedures, organizations can strengthen their compliance stance, enhance audit results, and ultimately boost overall business performance. Ongoing monitoring and refinement will guarantee that the framework stays pertinent and effective in tackling the changing landscape of compliance challenges.

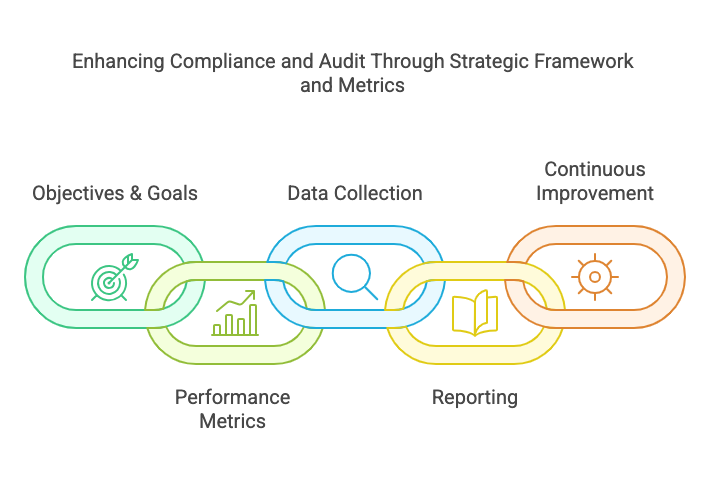

stablish clear objectives and goals for compliance and audit functions. These should align with the organization's strategic vision and regulatory requirements. Examples include:

Define key performance indicators (KPIs) to measure the effectiveness of compliance and audit activities. Common KPIs include

Implement systems for collecting and analyzing data related to compliance and audit activities. This may involve:

Establish a reporting framework to communicate performance results to relevant stakeholders. This should include:

Foster a culture of continuous improvement by regularly reviewing and updating the performance management framework. This can be achieved through:

StratRoom's Compliance and Audit Performance Management solution provides a robust framework that empowers organizations to manage compliance efficiently. By incorporating extensive tracking, risk management, performance metrics, and an intuitive design, StratRoom allows organizations to confidently navigate the intricacies of compliance and auditing.

StratRoom's framework offers a comprehensive compliance tracking system that allows organizations to monitor their adherence to various regulatory requirements. This feature includes automated alerts and reminders for upcoming compliance deadlines, ensuring that organizations remain proactive in their compliance efforts.

The framework includes tools for conducting thorough risk assessments, enabling organizations to identify potential compliance risks and develop mitigation strategies. This proactive approach helps in minimizing the likelihood of compliance breaches and enhances overall risk management.

StratRoom provides a detailed audit trail feature that records all compliance related activities and changes. This documentation is crucial for transparency and accountability, making it easier for organizations to demonstrate compliance during audits.

The framework includes customizable performance metrics and reporting tools that allow organizations to evaluate their compliance and audit performance effectively. These metrics provide insights into areas of improvement and help in making informed decisions.

StratRoom's Compliance and Audit Performance Management Framework is designed to integrate seamlessly with existing organizational systems. This feature ensures that compliance processes are streamlined and that data flows smoothly between different departments.

User Friendly InterfaceThe framework boasts a user friendly interface that simplifies navigation and enhances user experience. This accessibility ensures that all team members, regardless of their technical expertise, can effectively utilize the system.

API Integrations: Ability to integrate with other software systems to enhance data flow and operational efficiency

Third party Data Sources: Access to external industry compliance data providers for enriched insights and benchmarking.

StratRoom’s offerings empower businesses to elevate their compliance and audit performance management strategies. Through immediate access to insights, seamless integration of strategic initiatives, and robust support for operational execution, StratRoom enables organizations to achieve remarkable results and prosper within their sectors. Embracing these solutions is not merely a move towards enhanced compliance; it reflects a commitment to sustainable and responsible business operations.